Essential Tools for Accounting Teams: In-House vs. Outsourced

Businesses are continually seeking ways to enhance their accounting processes while maintaining efficiency and accuracy. Leveraging finance BPO services has become a strategic solution for organizations looking to optimize operations and reduce costs. With over 20 years of experience, Infinit-O has been helping businesses achieve business process optimization through business process outsourcing, enabling them to focus on their core competencies while ensuring compliance and financial accuracy.

The Need for Accounting Optimization

Accounting is a critical function for any organization, ensuring financial health and regulatory compliance. However, managing accounting services in-house can present several challenges, including resource constraints, manual inefficiencies, and scalability issues. As a result, businesses are increasingly adopting accounting automation tools and outsourcing solutions to streamline their operations.

According to a report by Grand View Research, the global finance and accounting outsourcing market is expected to reach USD 56.42 billion by 2027, driven by the need for cost reduction and process efficiency.

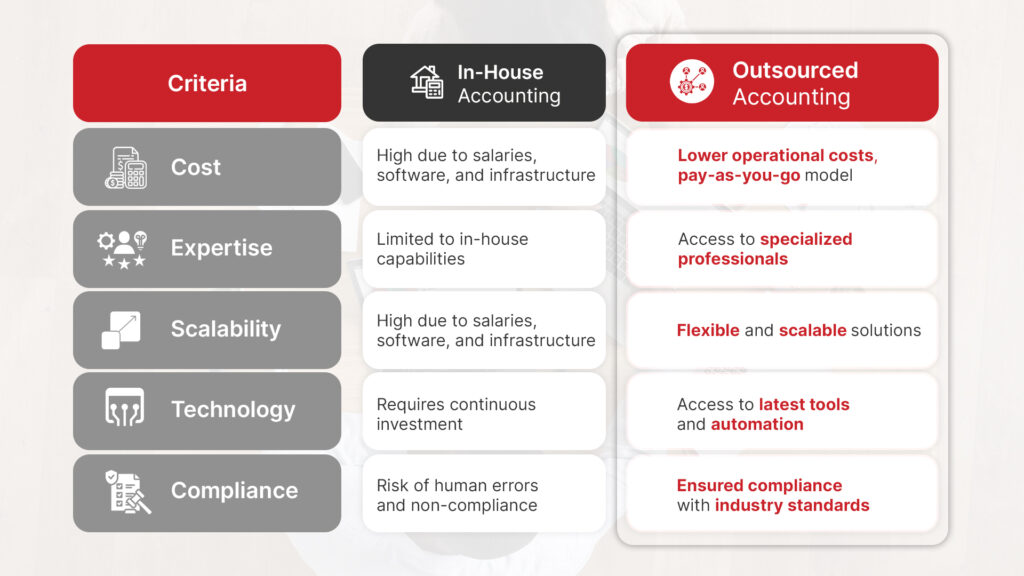

Comparing In-House vs. Outsourced Accounting

When deciding between in-house and outsourced accounting, it is crucial to consider factors such as cost, efficiency, and scalability. Below, we compare both approaches across key parameters:

Essential Tools for Accounting Efficiency

Regardless of whether businesses choose to manage accounting in-house or through outsourcing, having the right tools is essential for seamless operations. Below are some of the key tools and technologies that enhance accounting efficiency:

- Enterprise Resource Planning (ERP) Systems

- ERP platforms like SAP and Oracle integrate accounting with other business functions, providing a holistic view of financial data.

- They enable better decision-making and financial planning.

- Cloud-Based Accounting Software

- Tools like QuickBooks Online and Xero offer remote access, real-time updates, and enhanced collaboration.

- They reduce the need for manual data entry, improving accuracy and compliance.

- Robotic Process Automation (RPA)

- RPA tools automate repetitive tasks such as invoice processing and reconciliation, minimizing human intervention and errors.

- Automation in accounting can reduce processing time by up to 80%, leading to significant cost savings.

- Financial Reporting & Analytics Tools

- Solutions like Tableau and Power BI offer data visualization and actionable insights.

- They enable businesses to track key performance indicators and improve financial forecasting.

- Payroll Management Systems

- Software like ADP and Gusto help automate payroll processing, tax calculations, and compliance reporting.

- These tools are essential for businesses managing large workforces.

Benefits of Outsourcing Accounting Services

For businesses aiming to scale operations while maintaining financial accuracy, business process outsourcing offers several strategic advantages beyond cost savings and expertise:

- Operational Agility: Outsourcing allows businesses to quickly adapt to changing market conditions and regulatory requirements, ensuring flexibility in financial operations.

- Enhanced Data Security: Professional BPO providers invest in robust cybersecurity measures and compliance frameworks to safeguard sensitive financial information. Infinit-O, an ISO 27001 and 9001 certified company, ensures the highest standards of data protection and quality management to support your financial operations.

- Access to Advanced Analytics: Outsourcing partners often leverage data-driven insights and predictive analytics to provide actionable financial recommendations and improve decision-making.

- 24/7 Business Continuity: With global outsourcing partners, businesses can ensure around-the-clock accounting support, reducing turnaround times and improving service levels.

- Scalability on Demand: Whether facing seasonal spikes or rapid growth, outsourcing provides the ability to scale accounting functions without the need for internal restructuring.

How Infinit-O Empowers Businesses with Finance BPO Services

Infinit-O has been at the forefront of providing tailored finance BPO services, helping organizations achieve seamless financial operations through customized solutions. Our expertise spans across various industries, delivering efficiency, scalability, and cost-effectiveness. We provide end-to-end support in:

- General accounting and bookkeeping

- Financial planning and analysis

- Accounts payable and receivable management

- Tax compliance and audit support

- Payroll processing and reporting

Our approach to business process optimization ensures that clients benefit from streamlined workflows, reduced operational costs, and enhanced decision-making capabilities.

Conclusion

Choosing between in-house and outsourced accounting depends on a company’s financial goals, operational complexity, and growth aspirations. While in-house accounting offers direct control, outsourcing provides flexibility, cost efficiency, and access to advanced technologies like accounting automation.

Infinit-O’s 20+ years of experience in business process outsourcing enable businesses to optimize their financial operations, improve compliance, and achieve strategic goals. Ready to explore our accounting solutions? Contact us today to discover how we can support your business growth.

Infinit-O empowers finance and healthcare SMBs by being the trusted, customer-focused, and sustainable leader in business process optimization, driving continuous improvement through the integration of technology, data, and people.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.