Is Your Revenue Cycle Holding Your Healthcare Organization Back?

Managing a healthcare organization means balancing quality patient care with financial sustainability. However, inefficiencies in revenue cycle management (RCM) create ongoing challenges, from increasing claim denials to rising administrative costs and delayed reimbursements. These roadblocks don’t just slow down cash flow—they directly impact financial health and long-term growth.

The numbers tell the story:

- Claim denial rates have reached nearly 11%, costing hospitals and medical groups millions annually.

- Up to 25% of revenue is spent on administrative tasks related to billing and collections.

- 65% of denied claims are never reworked, leading to significant revenue leakage.

Without a streamlined RCM strategy, healthcare organizations risk revenue losses, compliance issues, and operational inefficiencies. Optimizing RCM processes with automation, AI-driven analytics, and business process enhancements can eliminate these challenges and improve financial performance.

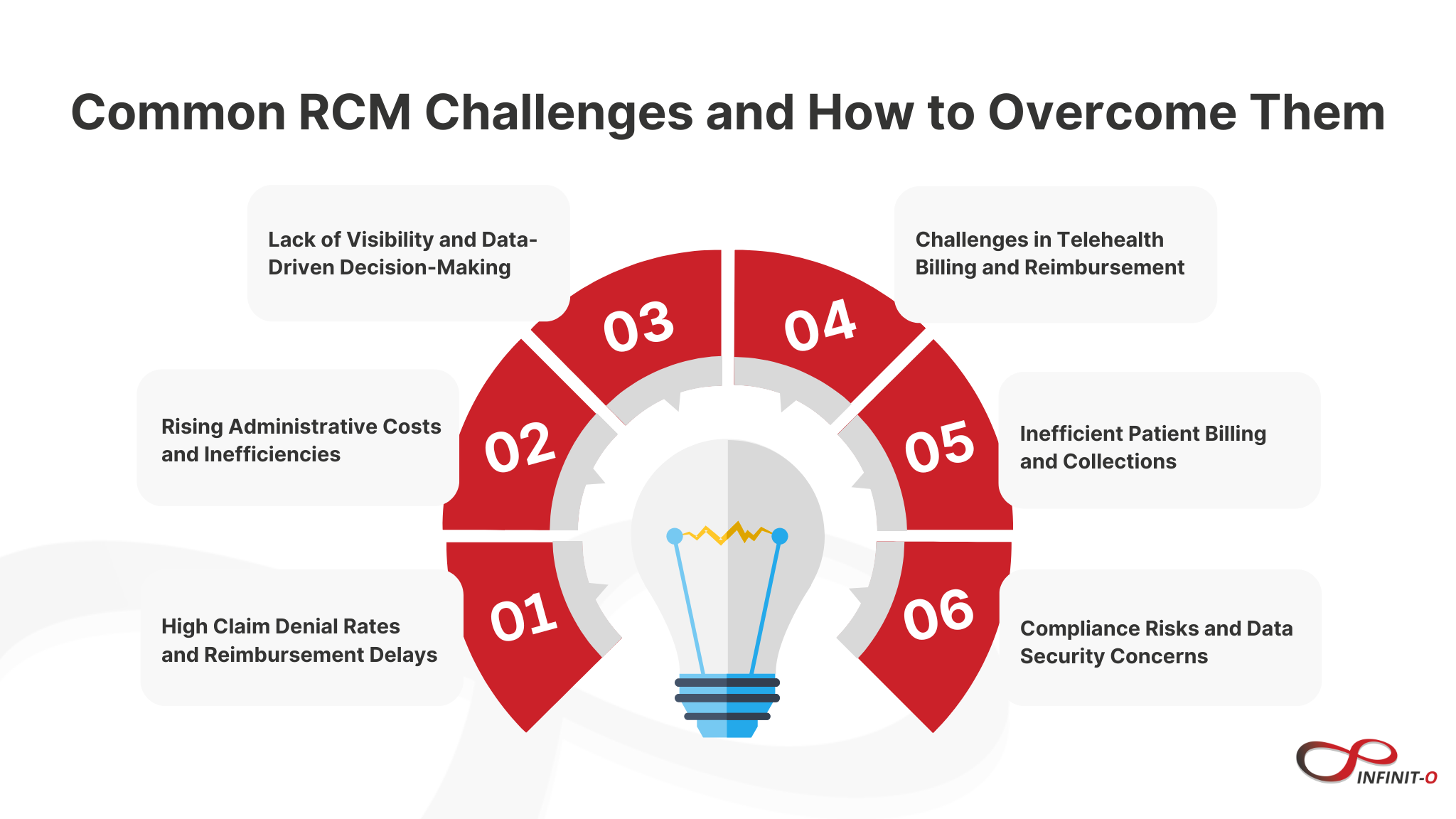

1. High Claim Denial Rates and Reimbursement Delays

The challenge:

Denied claims slow down cash flow, requiring additional time and resources for reprocessing. Many claims are denied due to coding errors, missing documentation, or payer noncompliance. Without a strong denial management strategy, revenue is lost.

How optimization helps:

- Automated claim scrubbing ensures accuracy before submission, reducing rejections.

- AI-driven analytics identify trends in denials and provide proactive solutions.

- Faster claims resolution improves reimbursement timelines and revenue stability.

2. Rising Administrative Costs and Inefficiencies

The challenge:

Manual processes in billing, claims processing, and collections increase operational costs and slow down workflows. Managing compliance updates and payer requirements adds to the administrative burden.

How optimization helps:

- Process automation streamlines tasks like eligibility verification, payment posting, and follow-ups.

- Workflow enhancements reduce errors and minimize the need for manual intervention.

- Lower operational costs allow organizations to reallocate resources toward patient care.

3. Lack of Visibility and Data-Driven Decision-Making

The challenge:

Without real-time insights into RCM performance, it’s difficult to track outstanding payments, identify revenue bottlenecks, or forecast financial trends.

How optimization helps:

- AI-driven analytics provide real-time reporting on revenue cycle performance.

- Predictive modeling helps forecast cash flow and improve financial planning.

- Customizable dashboards offer transparency into key financial metrics.

4. Challenges in Telehealth Billing and Reimbursement

The challenge:

Telehealth services have expanded rapidly, but inconsistent payer policies make billing complex. Many healthcare providers struggle to receive full payment for virtual visits.

How optimization helps:

- Automated coding and documentation ensure compliance with payer requirements.

- Specialized telehealth billing expertise maximizes reimbursements.

- Billing workflow improvements reduce rejected claims and ensure timely payments.

5. Inefficient Patient Billing and Collections

The challenge:

With increasing out-of-pocket costs, patient collections have become a major challenge. Unclear billing processes and outdated collection methods result in delayed payments and higher bad debt.

How optimization helps:

- Automated patient billing systems send reminders and offer flexible payment options.

- Transparent cost estimates improve patient trust and payment compliance.

- Optimized collection strategies increase revenue from patient balances.

6. Compliance Risks and Data Security Concerns

The challenge:

Strict regulatory requirements like HIPAA, GDPR, and evolving payer rules make compliance complex. Failing to meet security standards can lead to fines, legal consequences, and reputational damage.

How optimization helps:

- Built-in compliance safeguards ensure adherence to industry regulations.

- Robust cybersecurity measures protect patient data and financial integrity.

- Automated regulatory updates keep processes aligned with changing guidelines.

Transforming Healthcare Finances Through RCM Optimization

A well-optimized revenue cycle ensures financial stability, reduces inefficiencies, and improves cash flow. Healthcare organizations that embrace automation, AI-driven insights, and streamlined workflows can significantly enhance their revenue potential while staying focused on patient care.

Are revenue cycle inefficiencies affecting your financial performance? Now is the time to optimize.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.