How AR Automation Services Increased Revenue for a Healthcare Provider

Transforming AR to Strengthen Financial Performance

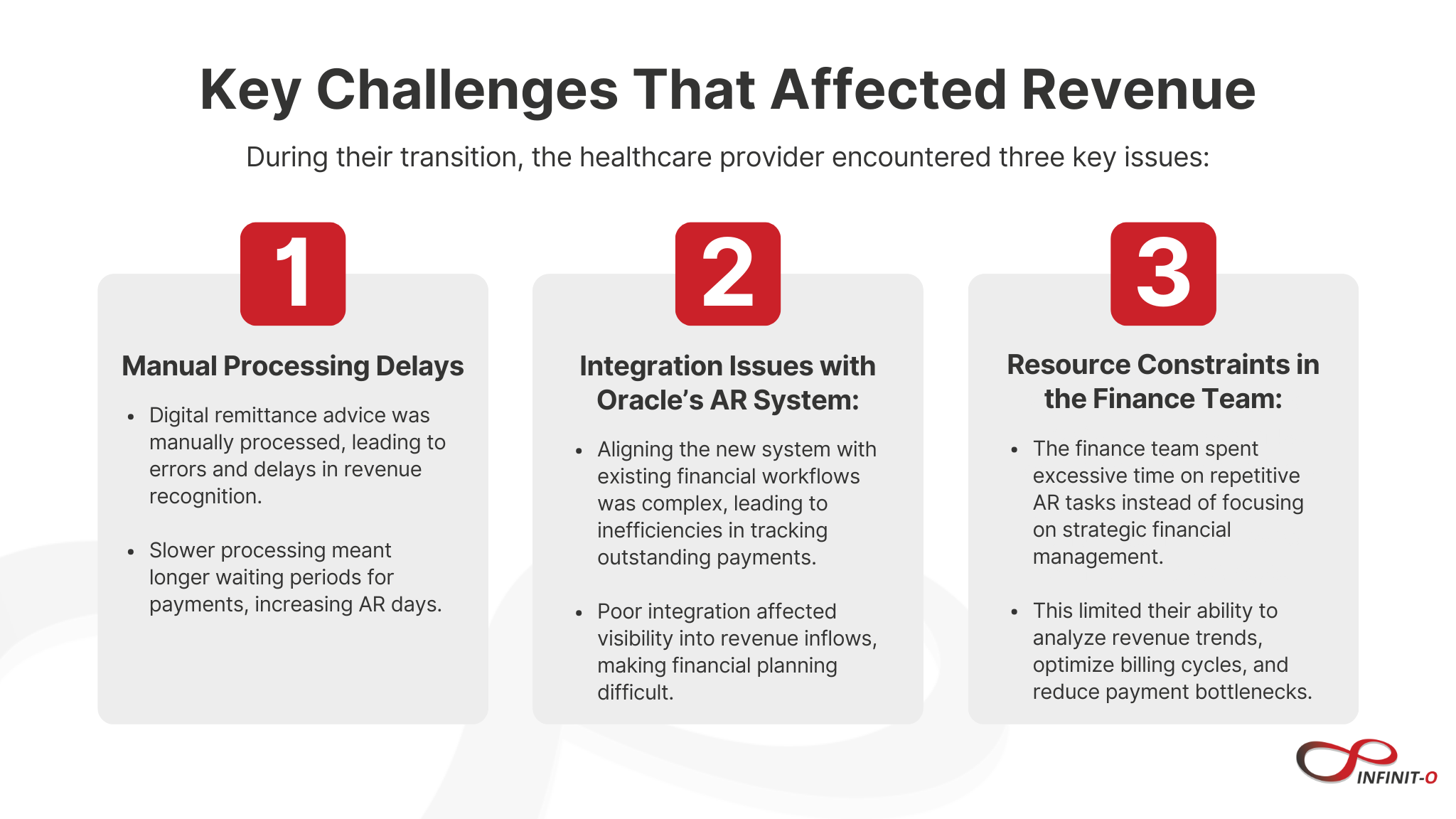

For healthcare providers, managing accounts receivable (AR) efficiently is crucial to maintaining a strong revenue cycle and steady cash flow. A mid-sized healthcare provider in the United States was facing significant challenges during their transition to Oracle’s AR system. Manual processes, integration issues, and resource constraints led to delayed collections, increased AR days, and inefficiencies that negatively impacted revenue.

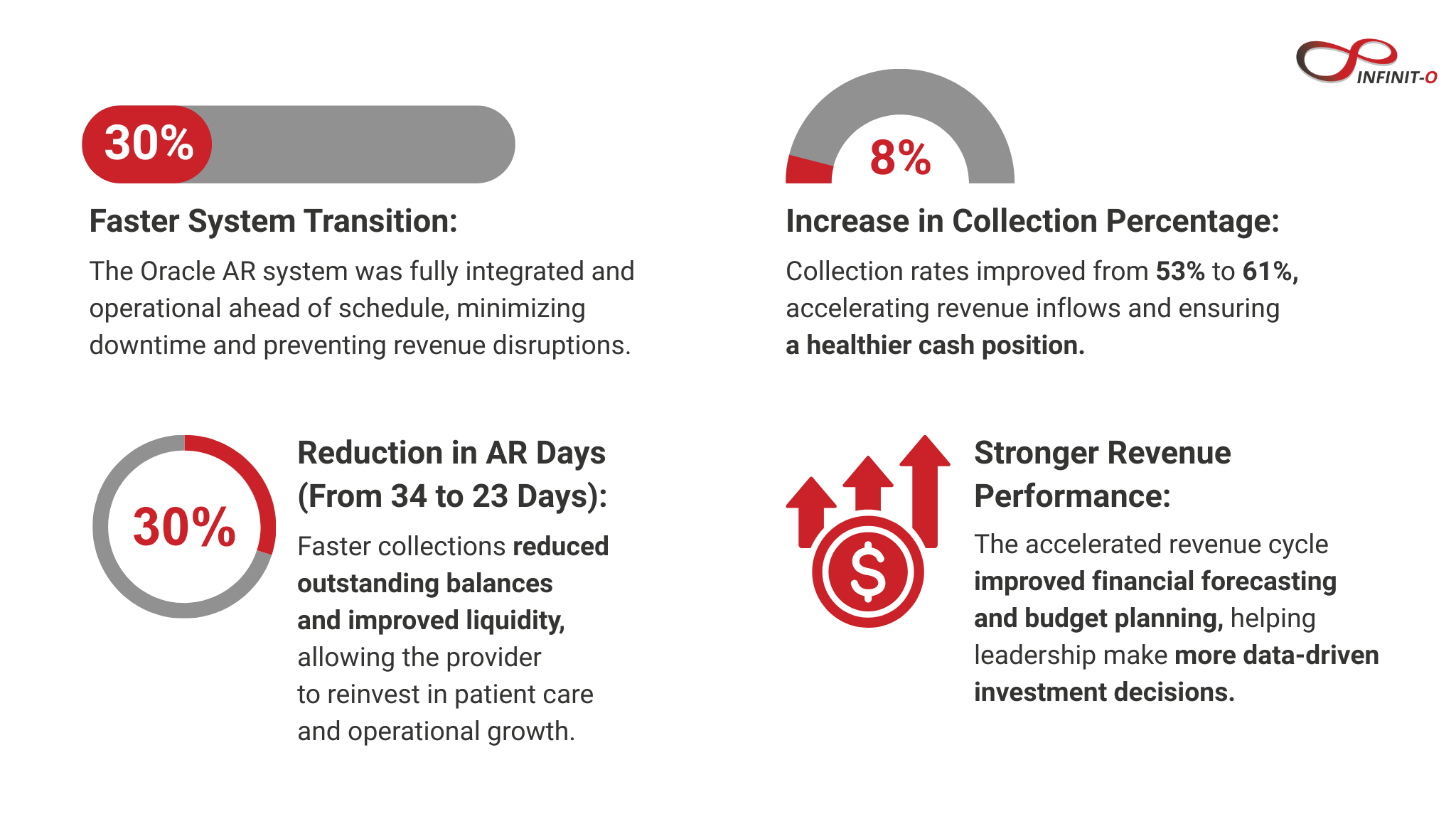

By implementing AR automation services, they streamlined their revenue cycle, resulting in a 32% reduction in AR days and an 8% increase in collection percentage—both of which directly improved their financial performance.

These inefficiencies led to delayed cash inflows, unpredictable revenue cycles, and increased operational costs.

The Solution: Automating the AR Workflow

To overcome these challenges, the provider implemented AR automation services, focusing on three key areas:

✅ Process Standardization:

- Standardized documentation and invoicing processes reduced errors and ensured consistency across all service lines.

- Eliminated discrepancies in billing, improving accuracy and reducing disputes that delayed payments.

✅ Automation & Seamless Integration:

- Automated data extraction from digital remittance advice eliminated manual entry, improving processing speed and accuracy.

- Seamless integration with Oracle’s AR system provided real-time visibility into outstanding payments and cash flow trends.

✅ Dedicated AR Support & Oversight:

- Personalized oversight ensured a smooth transition, addressing specific integration challenges.

- The finance team could shift their focus to revenue optimization and financial planning.

Results: Measurable Revenue Growth & Financial Gains

By automating their AR process, the healthcare provider saw tangible improvements in revenue cycle efficiency:

How AR Automation Directly Boosts Revenue

✅ Faster Payments → More Working Capital

- By reducing AR days, the provider had access to revenue sooner, allowing them to fund growth initiatives without relying on external financing.

✅ Reduced Manual Work → Lower Administrative Costs

- Automating manual tasks freed up financial resources, cutting down overhead costs and improving overall profitability.

✅ Fewer Billing Errors → Less Revenue Leakage

- Process standardization minimized invoice errors, reducing disputes and ensuring that payments were collected in full and on time.

Setting a New Standard for AR Optimization

By leveraging AR automation services, the healthcare provider not only improved their Order to Cash efficiency but also strengthened their financial stability and revenue growth. The combination of faster payments, improved collection rates, and reduced manual effort set a new benchmark for maximizing revenue potential in healthcare finance.🚀 Ready to improve your revenue cycle? Automate your AR process today and unlock faster collections, stronger cash flow, and sustainable financial growth.

Infinit-O empowers finance and healthcare SMBs by being the trusted, customer-centric, and sustainable leader in business process optimization, driving continuous improvement through the integration of technology, data, and people.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.