Transform Your Business: How BPO Drives Growth and Efficiency in Finance and Healthcare

Small and medium-sized businesses (SMBs) in finance and healthcare often face complex operational challenges. With growing demands for streamlined operations, improved customer experience, and regulatory compliance, these businesses need effective strategies to optimize their processes. Business Process Optimization (BPO) is an approach that allows SMBs to enhance efficiency, reduce costs, and focus on providing better customer experiences while staying competitive in the market. By integrating the right combination of people, data, and technology, SMBs can optimize their operations and unlock their full growth potential.

Optimizing Operations for SMBs in Finance and Healthcare

For SMBs in finance and healthcare, every operational process is critical. From managing financial transactions and regulatory compliance to delivering a seamless customer experience, businesses need to ensure that their operations are as efficient as possible. Business process optimization can help SMBs streamline workflows, eliminate redundancies, and improve overall performance.

By identifying inefficiencies, automating key processes, and adopting innovative solutions, SMBs can improve service delivery, reduce costs, and ultimately achieve sustainable growth in a highly competitive environment.

Why BPO Matters for SMBs in Finance and Healthcare

- Streamlining Complex Financial Operations

Finance SMBs often deal with complex transactions, compliance issues, and regulatory demands. BPO helps by simplifying financial processes such as transaction handling, reporting, and compliance management. Optimizing these processes not only saves time but also improves accuracy, allowing finance businesses to focus on enhancing their customer experience and strategic growth. - Optimizing Revenue Cycle Management in Healthcare

In healthcare, managing billing, insurance claims, and patient data is critical. BPO solutions tailored to healthcare SMBs can streamline these processes, reducing errors, improving turnaround times, and ensuring a smoother patient experience. By automating repetitive tasks and integrating technology, healthcare SMBs can focus more on patient care, enhancing both operational efficiency and customer satisfaction. - Enhancing Customer Experience

Across both sectors, delivering an exceptional customer experience is paramount. Whether it’s responding to patient inquiries or addressing client financial concerns, SMBs need reliable systems to manage these interactions. BPO solutions enable businesses to offload routine tasks, ensuring more timely, accurate, and personalized communication with clients and patients. This results in improved customer loyalty and satisfaction.

Key Benefits of Business Process Optimization for SMBs

- Increased Efficiency

Business process optimization can improve operational efficiency by up to 30%. By streamlining workflows, automating tasks, and eliminating unnecessary steps, SMBs can reduce cycle times and deliver faster services—whether in finance or healthcare—ultimately benefiting their customers with quicker responses and improved outcomes. - Cost Savings

One of the primary advantages of BPO is its ability to help SMBs reduce costs. By outsourcing non-core tasks, businesses can lower operational overheads, saving up to 25%. This allows SMBs to reallocate resources to more strategic initiatives, such as enhancing customer experience, expanding service offerings, or investing in growth. - Adaptability to Change

SMBs must be agile to remain competitive, especially in industries like finance and healthcare where market conditions and regulatory requirements frequently change. BPO enables businesses to adapt to new challenges up to 40% faster, ensuring they remain compliant and agile in a fast-moving environment. This helps companies stay ahead of industry trends and better serve their customers. - Improved Quality and Customer Experience

BPO doesn’t just improve operational efficiency; it also enhances service quality. SMBs in finance and healthcare can see a 15-20% improvement in quality, which directly contributes to a better customer experience. Faster response times, improved accuracy, and seamless service delivery all lead to higher customer satisfaction and loyalty. - Better Data Insights for Decision-Making

Business process optimization can improve data management, providing SMBs with valuable insights that guide decision-making. By having access to accurate and real-time data, SMBs can increase their decision-making accuracy by up to 35%. This allows businesses to make informed decisions about resource allocation, service improvements, and customer engagement strategies.

The Role of People, Data, and Technology in BPO

A successful BPO solution for SMBs combines the right people, data, and technology. This integrated approach ensures that operations are optimized to meet the specific needs of finance and healthcare businesses.

- People

Skilled professionals play a key role in optimizing business processes. From financial analysts to healthcare specialists, having the right expertise ensures that operations run smoothly and efficiently. These professionals work closely with SMBs to identify pain points and implement tailored solutions that drive better customer experiences. - Data

Data is at the core of business process optimization. SMBs that leverage data-driven insights can identify inefficiencies, track performance, and make better decisions. By using advanced data management and analytics tools, businesses can continually refine their processes and improve the overall customer experience. - Technology

Technology is a critical enabler of BPO. Automation, cloud-based platforms, and advanced analytics tools can streamline processes and help SMBs deliver services faster and more accurately. With technology, businesses can ensure that their operations remain efficient, secure, and scalable, even as they grow.

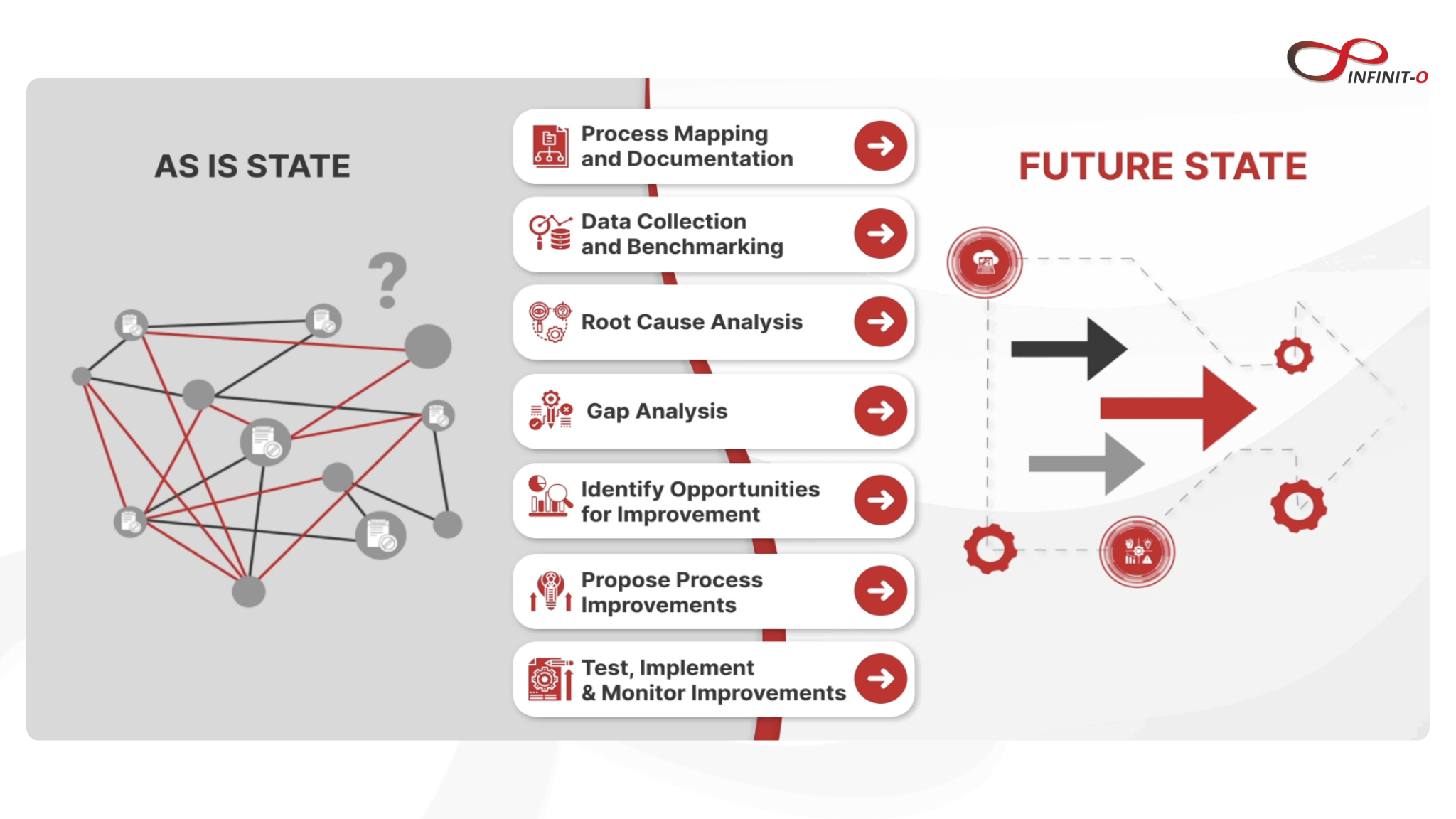

A Holistic Approach to Optimization

Business process optimization is not just about outsourcing certain functions—it’s about taking a holistic approach to process improvement. By integrating BPO solutions within the larger framework of Business Process Management (BPM), SMBs can optimize every phase of their operations: from process design and execution to monitoring and continuous optimization.

This holistic approach ensures that SMBs not only eliminate inefficiencies but also create a sustainable framework for growth and customer satisfaction. By focusing on continuous improvement, businesses can stay adaptable and responsive to changing customer needs and market conditions.

Conclusion: Achieving Sustainable Growth Through BPO

Business process optimization offers a valuable opportunity for SMBs in finance and healthcare to streamline operations, reduce costs, and improve service delivery. By combining the right people, data, and technology, SMBs can optimize their processes to enhance the customer experience and position themselves for long-term growth.

Business process optimization isn’t just about cutting costs—it’s about improving every aspect of your operations, from speed and accuracy to customer satisfaction. With a tailored BPO solution, SMBs can enhance their operational efficiency, deliver better customer experiences, and unlock sustainable growth opportunities.

If you’re looking to improve your business operations and take your customer experience to the next level, consider exploring how business process optimization can help you achieve your goals.

Infinit-O empowers finance and healthcare SMBs by being the trusted, customer-centric, and sustainable leader in business process optimization, driving continuous improvement through the integration of technology, data, and people.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.