Why You Should Look for a Sarbanes-Oxley Act Compliant Outsourcing Partner

Due to the occurrence of major accounting scandals over the past two decades, in the US, the Sarbanes-Oxley Act was enacted in 2002 as a way to mandate companies to be transparent in their financial reporting and to impose better internal controls and measures for corporate governance. The main goal of Sarbanes-Oxley (SOX) is to prevent fraud and protect those who invest in public companies.

More than just a regulatory requirement, SOX compliance is considered a good business practice as it encourages better security measures and protects the company from cyber attacks and other risks. It is also an indicator that a business has good corporate financial stability, which uplifts reputation and inspires investor confidence.

All publicly traded companies as well as wholly-owned subsidiaries and foreign companies that are publicly traded and do business in the United States must comply with SOX, including outsourcing companies. Businesses that wish to seek the services of a third-party outsourcing provider especially for finance and accounting processes should choose one that is SOX compliant for the benefit of their key stakeholders and because of the following advantages:

Strong financial reporting

Under Section 404 of the SOX Act, companies are required to prepare reports that detail their internal controls and financial reporting procedures and assess their effectiveness. They also use a framework that guides them in handling their financial records better. Through these good practices, SOX compliant companies are able to enhance the quality of their financial reporting, which results in the improvement of many other aspects of the operations including easier access to capital markets.

Improved audits

Most companies view internal and external audits as something that is done annually or quarterly, at most. However, what they fail to realize is that audit functions can result in significant improvements in corporate risks if developed properly. Fortunately, complying with SOX regulations encourages companies to institutionalize their audits, which can help them identify key financial and corporate risks much earlier and result in a lower cost of overall risk management.

Protection from cyber attacks

Another significant advantage of SOX compliance is the fact that it helps companies prepare for and deal with cyber threats. Cyber attacks and data breaches compromise sensitive data and information, which will not only cost a company a lot to manage but also put its reputation and consumership on the line. The regulations under SOX outline the best practices they can follow to ensure that this will not happen in the future, and if it ever does, they are prepared to handle it.

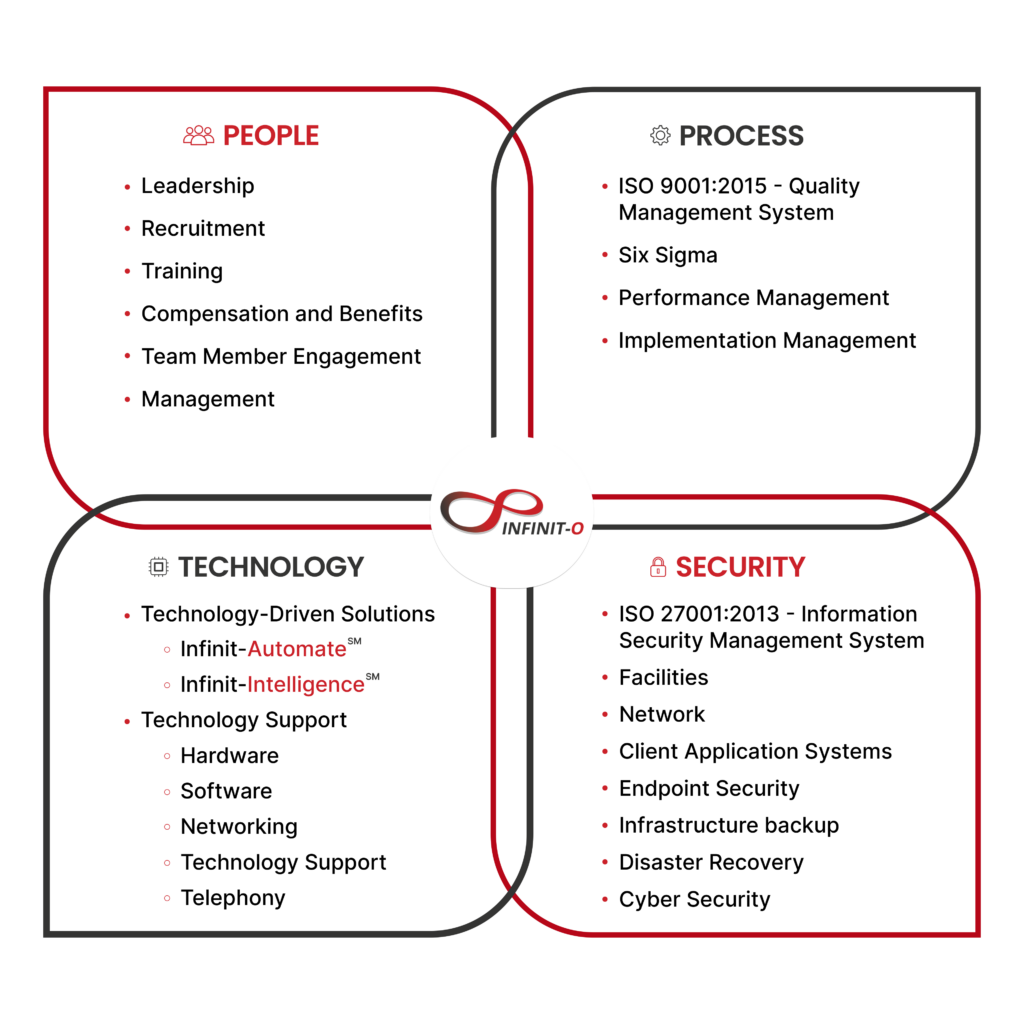

Aside from SOX compliance, choose an outsourcing company that also ensures:

Partnership with Infinit-O

- Access to talent through their A+ recruitment process

- Cost savings of up to 70%

- Adaptability in technological advancement

- Established Information Security

- Operational excellence

- A great F&A team

- Information and data security

- 71 Net Promoter Score: Sense of security and peace of mind

Infinit-O’s mission is to create endless opportunities for your company to realize its full potential.

Let’s work together to build a great F&A Team.

Start small. Exceed expectations. Think infinitely. Think Infinit-O.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.