How to Spot a Great Risk Management Expert

While risk management is seen as a crucial part of a business, it is a function often overlooked by many companies, not knowing the benefits of taking full advantage of it. For one, a dedicated risk management team composed of experts can provide useful advice on the potential risks to a company’s sustainability and profitability. And in the case of something going wrong, they already have a plan of action to reduce and mitigate risk, and avoid bigger losses.

A good risk management expert has many qualities: they work well under stress, think quickly on their feet, and constantly strive to learn more. On top of these, here are three key skills that you should consider when looking for a risk management expert to add to your team:

- Analytical skills

In risk management, it is important to be quick but thorough in analysing data in order to assess risk, calculate its potential effects to the company, and find strategic solutions to prevent it efficiently. Moreover, a risk management expert possessing good analytical skills can focus on the broad aspects of the job yet still have a keen eye for smaller details that happen on the day to day. This is especially helpful in detecting and mitigating problems at the root and areas that are often overlooked.

- Business understanding and industry knowledge

Risk management experts must have a deep understanding of the ins and outs of the firm or company they are working for as well as the external and internal factors that can affect its performance in order to properly predict and assess risks. They should also understand and master the different financial indicators tied to the firm or company’s assets, stakeholders, markets, and regulations. Alongside being well-versed in business issues, it is also ideal to be knowledgeable of the industry where the firm or company operates to easily identify what risks may arise.

You may want to look for applicants who hold academic credentials or certifications in finance or other related fields to assure they can perform the duties that the job requires.

- Communication and negotiation

Risk management is at the crossroads of the operational, financial, accounting , and strategic functions of a business, which is why a risk management expert must be equipped with good communication skills to be able to properly convey complex financial products, and risk management concepts and policies to the rest of the firm or company – from the board of directors to individual employees – composed of varied audiences of different ages and understanding of the topic.

In relation to this, risk management experts must also know how to negotiate with other departments, for example, when it comes to policies, and deal with different kinds of people on the job.

Outsourcing your risk management team

Now that you know what to look for in your risk management team, partnering with a reputable outsourcing company is the next best step. While you can opt to hire or train your staff for risk management duties, you can save more time and resources when you outsource since you no longer have to shoulder hiring and training costs.

Pro Tip: High Net Promoter Score (>60 NPS)

Net promoter score helps businesses gauge the quality of the customer service offered by outsourcing companies. Organizations can use NPS to assess which outsourcing service is best to partner with because this score shows loyalty trends and growth revenue outputs.

In a way, NPS represents the primary way customers survey their experience because it means that their clients are happy which results in customer loyalty and retention, making this a critical trait a BPO company should have. When used correctly, NPS (of at least 60%) can tell you how well the BPO is performing, how often they resolve issues, and if their clients are satisfied with their experience.

Outsourcing also gives you access to a pool of trained experts in risk management that can help you draw up a crisis prevention plan that is tailor-fit for the unique needs of your company.

Look for a trusted outsourcing company that can help you build a dedicated Risk Management team that has:

- Access to talent through their A+ recruitment process

- Cost saving of up to 70%

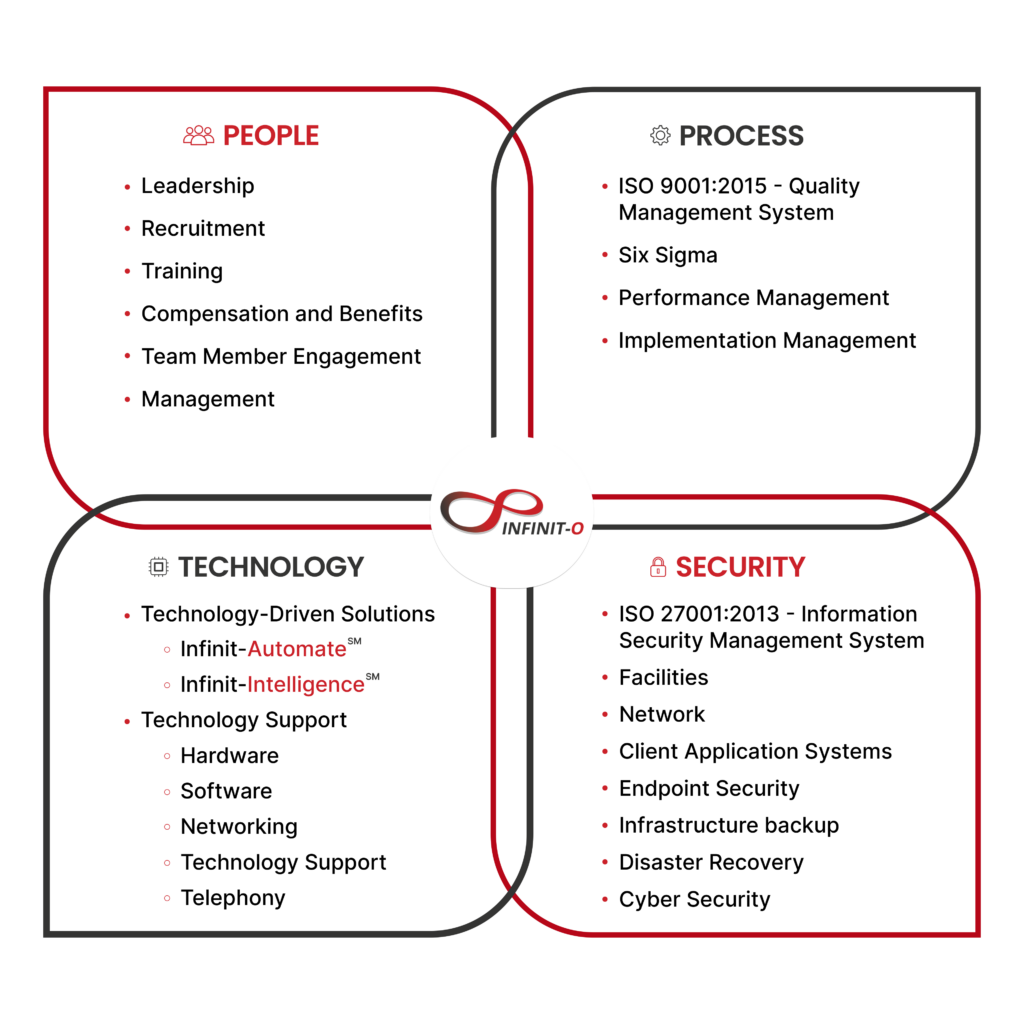

- Adaptability in technological advancement

- Established Information Security

- Operational excellence

- A great F&A team

- Information and data security

- Sense of security and peace of mind

Partnership with Infinit-O

Infinit-O’s mission is to create endless opportunities for your company to realize its full potential.

Let’s work together to build a great Risk Management Team.

Start small. Exceed expectations. Think infinitely. Think Infinit-O.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.