Skills and Competencies of a Great Fund Manager

Delving in mutual funds have become popular among investors looking to increase their assets because unlike other forms of investing, these are actively managed by fund managers who decide whether to buy, sell, or hold assets. Being such a key role in a company, it is important to hire the ideal fund managers to ensure that assets are managed correctly and are as cost-efficient and profitable as possible.

When looking for fund managers to add to your team, here are some skills and competencies that they should possess:

- In-depth industry knowledge

Since they will be dealing with a fund’s investment strategy and managing its trading activities, your fund manager should have a sizable knowledge of financial instruments and products including options, futures, commodities, interest rates, and exotics. They also need to be familiar with the existing marketplace, competitor developments, and regulations.

Although it is now a requirement, one way to guarantee that your candidate is well-equipped for the role is to look for the following certifications, licenses, and other credentials:

- Registered Investment Advisor (RIA) from the Financial Industry Regulatory Authority (FINRA)

- Chartered Financial Analyst (CFA) from the CFA Institute

- Chartered Hedge Fund Associate (CHA) from the Hedge Fund Group

- Series 65, a licensing program offered by FINRA that permits hedge fund managers to act as an investment adviser

- Series 3, a licensing program administered by the National Futures Association necessary to trade futures or commodities

- Quantitative expertise

Another skill that a good fund manager should have is being able to analyze quantitative models and calculation dependencies in order to make recommendations and predictions about future prices and trends. In short, they should be good in number crunching and statistical analysis. On top of this, they must be well-versed on risk assessment as well, may it be of individual financial products, portfolios and combinations.

- Communication Skills

Being an articulate and effective communicator is a must for the role of a fund manager since there will be times, albeit occasionally, that they have to face clients and present complex products, findings and recommendations regarding the assets they are managing. This skill also comes in handy when pitching ideas to the team.

Outsourcing your fund managers

Having a dedicated team of fund managers and associates in your company is made easier, not to mention more cost-efficient, when you partner with a trusted outsourcing company. It has high-quality and specialized financial and accounting services that can help you manage your fund effectively and put the focus of the rest of your staff back to their respective core services.

Pro Tip: High Net Promoter Score

Net promoter score helps businesses gauge the quality of the customer service offered by outsourcing companies. Organizations can use NPS to assess which outsourcing service is best to partner with because this score shows loyalty trends and growth revenue outputs.

In a way, NPS represents the primary way customers survey their experience because it means that their clients are happy which results in customer loyalty and retention, making this a critical trait a BPO company should have. When used correctly, NPS (of at least 60%) can tell you how well the BPO is performing, how often they resolve issues, and if their clients are satisfied with their experience.

Through outsourcing, you can also get access to specialized accounting systems that have become essential to the industry due to investors’ demand for more transparency. When not outsourced, these systems can be very expensive not only for its market price but also because of the support, maintenance, and training that these entail.

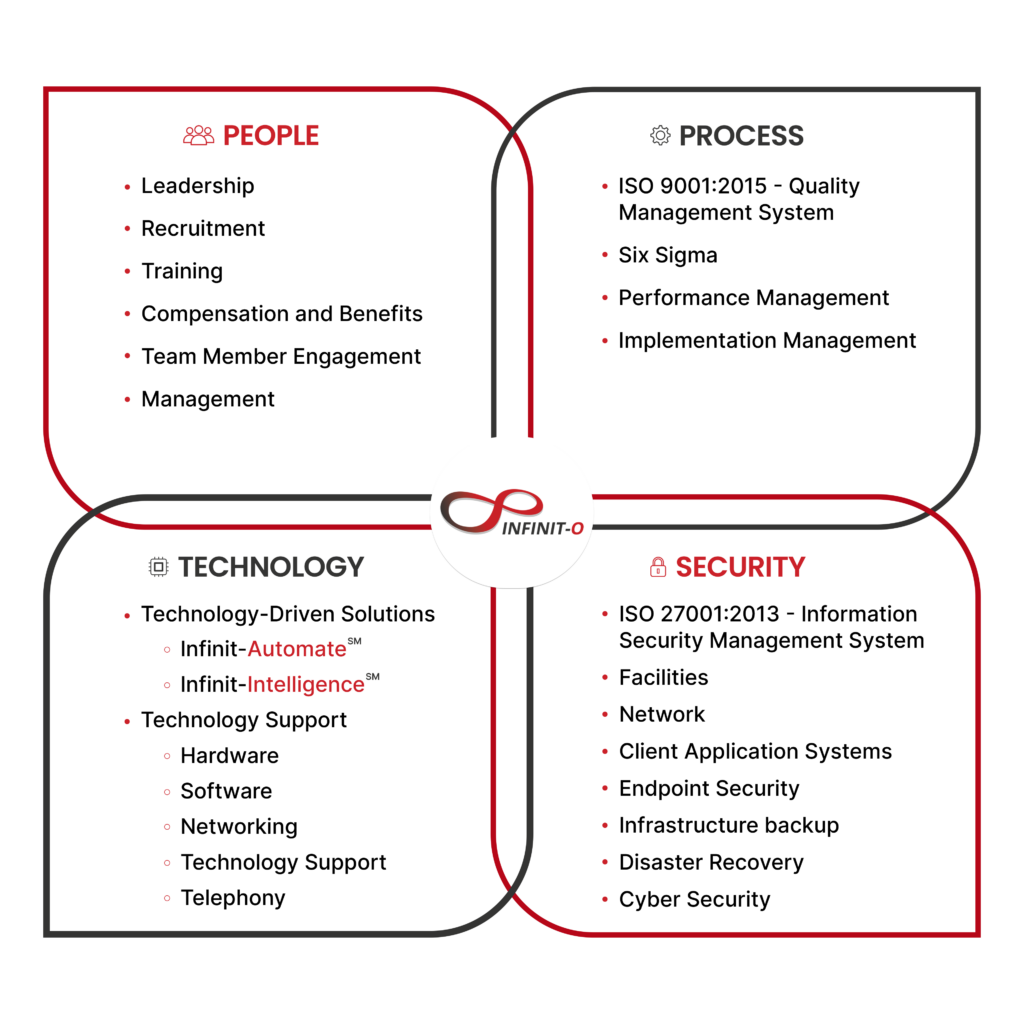

Look for a trusted outsourcing company that can help you build a dedicated Fund Management team that has:

- Access to talent through their A+ recruitment process

- Cost saving of up to 70%

- Adaptability in technological advancement

- Established Information Security

Lastly, the right outsourcing partner promises for the following:

- Operational excellence

- Having a great F&A team

- Operational cost savings of up to 70%

- 98% reduced error rate

- Information and data security

- Sense of security and peace of mind

Partnership with Infinit-O

Infinit-O’s mission is to create endless opportunities for your company to realize its full potential.

Let’s work together to build a great Fund Management Team.

Start small. Exceed expectations. Think infinitely. Think Infinit-O.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.