Optimizing Investment Strategies: How

Infinit-O Enhanced Due Diligence for a Private Equity Firm

Challenge

A private equity firm faces challenges in effectively managing due diligence and monitoring its portfolio companies:

- Resource Limitations: The firm lacks the internal resources needed to conduct thorough due diligence and ongoing assessments efficiently.

- Need for In-Depth Analysis: Inadequate analysis may lead to less informed investment decisions and increased risk exposure.

- Lack of Focus on Core Activities: The firm struggles to concentrate on high-value activities like deal sourcing and negotiations due to operational constraints.

Solution

Infinit-O implements a focused strategy to enhance due diligence processes:

- Dedicated Research and Analysis Team: A team of financial analysts and market researchers is assigned to provide expert support.

- Data Analytics Tools: Comprehensive analytics tools are utilized to deliver detailed financial reports and risk assessments.

- Streamlined Reporting: The enhanced reporting process enables more efficient data gathering and analysis for informed decision-making.

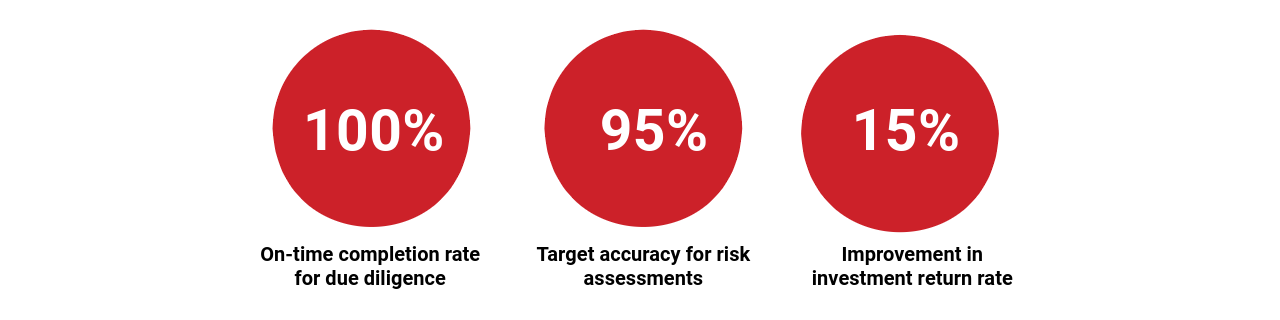

Outcome

The implementation of these solutions leads to improved investment strategies and reduced risk:

With Infinit-O’s tailored approach, the private equity firm can confidently navigate investment opportunities, ensuring strategic growth and long-term success.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.