Functions of an Outsourced ID Verification Team

In today’s digital world, the probability of identity theft, online fraud, and money laundering happening has gone higher, especially during the pandemic period. According to a report, 47 percent of Americans experienced financial identity theft in 2020, with losses costing $712.4 billion in total. This is why business owners have to take a step further and innovate when it comes to their identity verification processes.

Financial institutions and businesses can manage risk better by verifying the identity of new customers, and checking their history and previous behavior. Based on this, they can identify risk indicators, if there is any, that can threaten the organization and its existing customers, and will be able to act on it accordingly.

A dedicated team of ID verification specialists in your company can help with the following main functions:

Systematic KYC document review and customer verification

The process of identity verification involves Know Your Customer (KYC) standards, which are designed as protection for financial institutions (and their customers) against fraudulent and other suspicious activities.

Under this, ID verification specialists check and review customer identity and information based on the documentations they have submitted. Then, they assess the legitimacy of their source of funds and whether an individual has any risks (terrorist history, criminal activity, political exposure, or governmental sanctions) that can impact the organization negatively. Depending on the results, they decide on what necessary actions to take on accounts.

Customer monitoring

The work of an ID verification specialist is not limited to just checking documents and screening customers alone. To better manage and mitigate risks associated with high-risk customers, they also have to monitor and evaluate existing customers’ transactional behavior for any suspicious activity that may put the company at risk of fraud and take immediate preventive measures to mitigate this.

Policy review

Lastly, ID verification specialists are responsible for observing compliance to KYC, Anti-Money Laundering (AML) requirements and other existing regulations. Aside from protecting the company and their customers, this also prevents the occurrence of non-compliance fines or future costs of retroactive compliance.

Outsourcing ID verification

When looking to add an ID verification team in your operations, consider the benefits of outsourcing. Aside from cost-cutting, you also get access to trained and experienced specialists and the necessary software and technology for the role, resulting in a more efficient verification process.

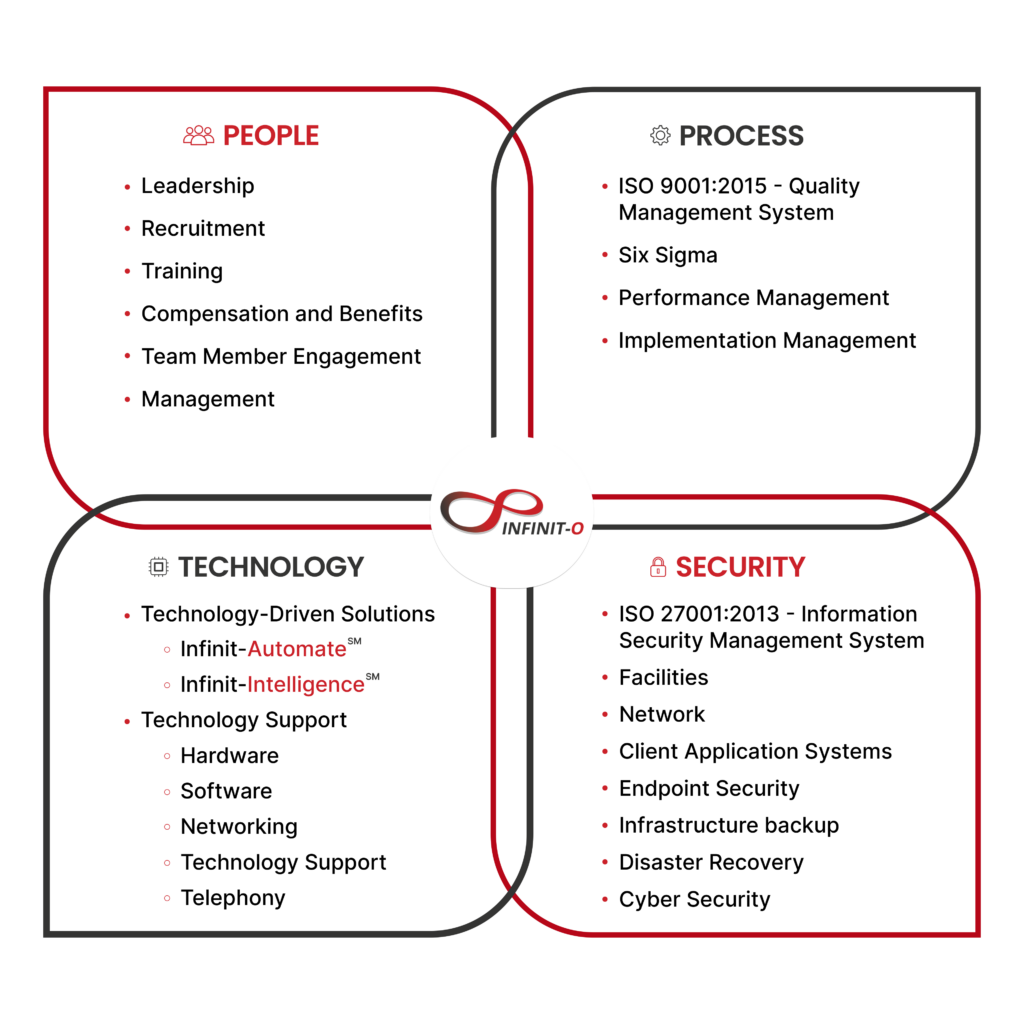

For the best results, it is important to team up with an outsourcing partner that makes your process, their process. Additionally, they ensure:

- A great recruitment team

- Operational excellence

- Industry experience

- Operational cost savings of up to 70%

- Information and data security

- >60 Net Promoter Score: Sense of security and peace of mind

High Net Promoter Score = Operational Excellence

When looking for an outsourcing partner, another thing you must remember is to partner with one that has a High Net Promoter Score. Net Promoter Score (NPS) helps businesses gauge the quality of the customer service offered by outsourcing companies. Organizations can use NPS to assess which outsourcing service is best to partner with because this score shows loyalty trends and growth revenue outputs.

In a way, NPS represents the primary way customers survey their experience because it means that their clients are happy which results in customer loyalty and retention, making this a critical trait a BPO company should have. When used correctly, NPS (of at least 60%) can tell you how well the BPO is performing, how often they resolve issues, and if their clients are satisfied with their experience.

Partnership with Infinit-O

Infinit-O’s mission is to create endless opportunities for your company to realize its full potential.

We can build you a great, high-performing Back Office support team:

- ID Verification Specialist

- Recruitment Specialist

- Employee Relations Officer

- HR Compensation & Benefit Specialist

- HR Data Management Specialist

- HR Employee Engagement Specialist

- Payroll Specialist

- Data Entry Specialist

- Others

Let’s work together to build a great Back Office Team.

Start small. Exceed expectations. Think infinitely. Think Infinit-O.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.