Fund Accountant: In-source vs Outsource

As suggested by current industry data, outsourcing has become an accepted and growing practice in the alternative investment industry, and among the most commonly outsourced components of operations is fund accounting, which is a crucial part of fund administration. Fund accountants mainly have the duty to calculate and report the daily Net Asset Values (NAVs) per unit as well as compile standard weekly and/or monthly financial statements and income and expense accruals among others.

While hiring fund accountants in-house has its own benefits like flexibility of tasks and loyalty to the company, it is also more taxing on the budget and other resources considering you have to undergo the process of recruitment and training as well as invest on office space and IT infrastructure. Outsourcing proves to be the more advantageous route in the long run because it is scalable, cost-efficient, and helps reduce and mitigate risks in businesses.

Here are 4 major advantages when you choose to outsource your fund accounting services:

- Access to Industry Expertise

Partnering with a reputable outsourcing provider gives you access to experts in financial and accounting services who can help you manage your fund effectively. Having a team of professional fund accountants is necessary to make sure that accurate monitoring of accounting processes and compiling regulatory financial reports are observed to improve performance and ensure transparency for your investors. Not only are they added manpower, they also possess the needed skills and expertise such as account management, bookkeeping, and fund analytics when it comes to the processes involved.

With this, you are guaranteed of accurate financial records, compliance to regulatory requirements for both onshore and offshore alternative investments, and minimal resources spent on overhead costs.

- Putting Focus Back on Core Services

Outsourcing fund administration tasks like accounting will lessen the burden of increased regulatory requirements and complex investor requests on the shoulders of fund managers. In turn, this will allow them to focus on their core competencies such as creation of fund structures and servicing investors to raise and deploy capital.

- Technology Solutions

By outsourcing your fund accounting services from a trusted and experienced provider, you also get access to specialized accounting systems (e.g. Quicken Premier, Master Investor, etc) that have become essential to the industry due to investors’ demand for more transparency. When not outsourced, these systems can be very expensive not only for its market price but also because of the support, maintenance, and training that these entail.

Moreover, information technology outsourcing (ITO) has enabled many financial investment firms to take advantage of secured and integrated software as a service (SaaS) systems and cloud computing technology. ITO gives you the freedom from having to worry about the high cost of building on-site IT hardware infrastructure.

- Allows Remote Working

According to leading investor services group, IQ-EQ, the trend of outsourcing in the fund administration industry is driven by the ever-changing regulatory landscape, increasing investor demands and rapidly evolving use of technology. With the global pandemic, however, outsourcing has become more rampant due to the need to operate from a remote and virtualized environment.

In fact, the 2020 KPMG/AIMA Global Hedge Fund Survey: COVID-19 special edition found that 71% of its respondents who are all fund managers agreed that the current experience of working remotely has convinced them they could achieve better efficiencies if they outsource some of their operations. Among the variety of functions included in the survey, the top two that respondents are more likely to outsource are administrative services, and tax and accounting services. But with the right outsourcing partner, remote work is not risky because they have Information Security in place.

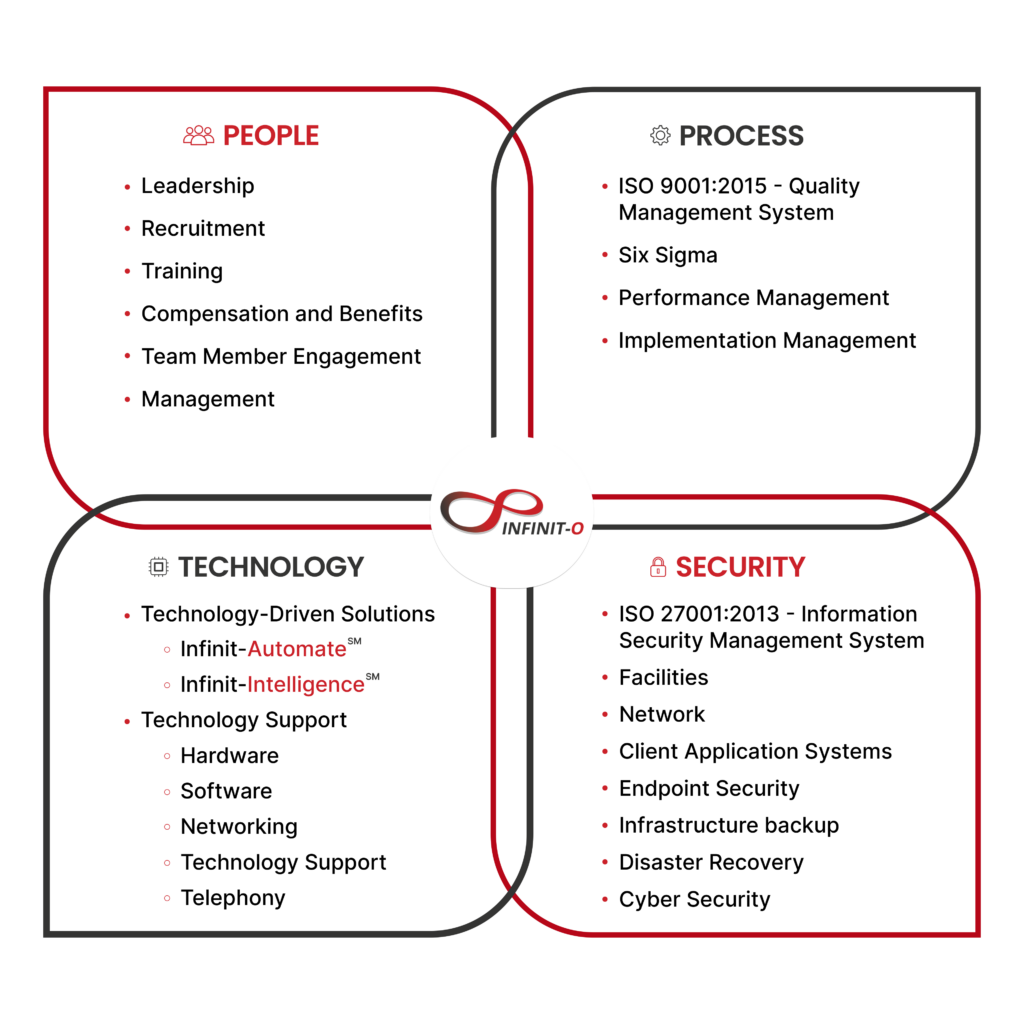

Look for a trusted outsourcing company that can help you build a dedicated Fund Accounting team that has:

- Access to talent through their A+ recruitment process

- Cost saving of up to 70%

- Adaptability in technological advancement

- Established Information Security

Lastly, the right outsourcing partner promises for the following:

- Operational excellence

- Having a great F&A team

- Operational cost savings of up to 70%

- Accuracy and quality

- Timeliness in submission

- Information and data security

- Sense of security and peace of mind

Partnership with Infinit-O

Infinit-O’s mission is to create endless opportunities for your company to realize its full potential.

We can build you a great, high-performance Fund Accounting and other F&A team composed of:

Let’s work together to build a great Fund Accounting Team.

Start small. Exceed expectations. Think infinitely. Think Infinit-O.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.